Imagine managing all your business payments, contractor wages, customer rebates, employee expenses—with a single, branded solution. It sounds complex, but API-driven prepaid debit cards for businesses are making it a reality, leaving old-school methods like paper checks and slow ACH transfers in the dust. This guide breaks down how a developer-first platform gives you the power to issue your own white-label open loop cards and take back control of your entire payment ecosystem while re-enforcing your own brand.

Why Modern Companies Run on Prepaid Debit Cards

Not too long ago, business payouts were a mess. Companies were stuck juggling a patchwork of systems: cutting checks for vendors, running ACH for payroll, and buying generic gift cards for rewards programs. It created a ton of administrative friction, payments were always delayed, and you got zero brand recognition out of it.

Today, things look completely different.

Smart companies are now using prepaid debit cards for businesses to bring all those separate payment streams into one clean, efficient system. Think of it less like a plastic card and more like a programmable financial toolkit. With a developer-first card issuing platform like Swype, you can build custom payment solutions with APIs that plug directly into your existing software. This lets you create and manage your own white-label card programs that carry your brand, not someone else’s.

Unifying Payouts, Rewards, and Incentives

The real magic is in their versatility. Instead of juggling multiple payment vendors and platforms, a single API-driven card program can do it all. This unified approach doesn't just cut down on headaches; it turns a simple payment tool into a strategic asset for growth.

Most companies put these cards to work in three key areas:

- Streamlined Payouts: Instantly push funds to gig workers, contractors, or affiliates, whether they're across town or across the globe. You get to skip the frustrating delays and high fees that come with traditional wire transfers.

- Branded Rewards and Incentives: Launch your own custom-branded virtual or physical cards for customer loyalty programs, rebates, or even employee recognition. It creates a memorable experience that a generic gift card just can't compete with.

- Controlled Corporate Spending: Give employees cards with spending controls you can set from a dashboard. You can limit how much they spend, where they spend it, and on what categories. Expense management gets simpler overnight, and the reimbursement runaround disappears.

By bringing card issuing in-house with an API, companies are no longer just using a payment product—they are building their own financial experiences. This shift provides unparalleled control, speed, and branding capabilities that are essential for scaling in a competitive market.

Understanding How Prepaid Card Issuing Actually Works

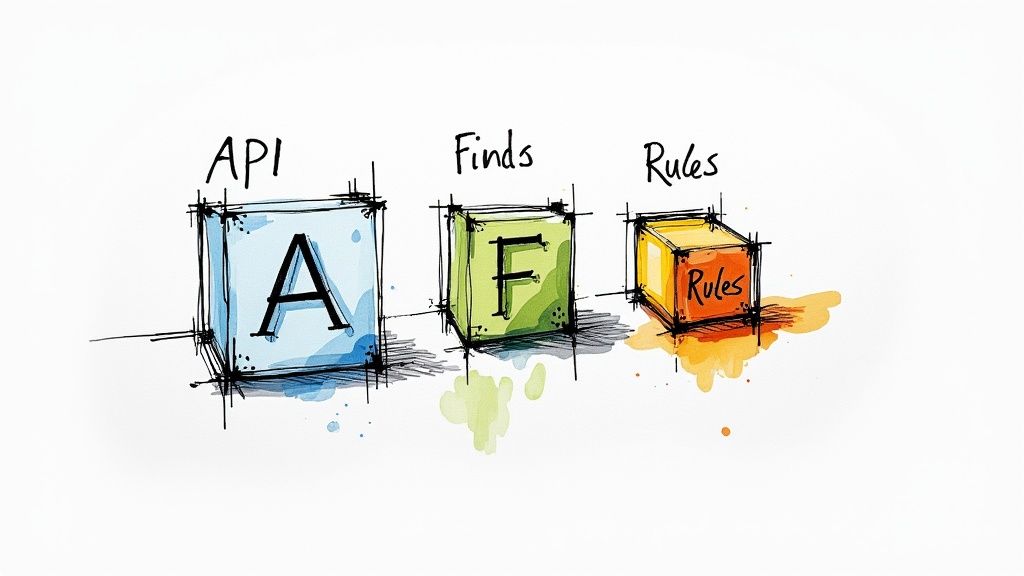

To really get why prepaid debit cards for businesses are such a big deal, you have to look past the plastic and peek behind the curtain at something called "card issuing." Not too long ago, trying to create your own card program was a massive undertaking, something only the big banks could even think about. Now? Modern platforms have completely changed the game, making it accessible to any business with developers.

Think of a modern card issuing API as a set of financial LEGOs. Instead of getting a pre-built, one-size-fits-all payment system, a developer-first platform gives you individual, programmable blocks. These APIs let you build a payment solution that fits your company's exact needs, whether you're handling payouts, dishing out rewards, or managing day-to-day operational expenses.

The Core Mechanics of a Modern Card Program

So what's really happening when a card gets issued? It’s a bit of a team effort, with a few key players working in concert. When you team up with a developer-first platform, you're essentially plugging into a ready-made financial infrastructure that does all the heavy lifting. This frees you up to focus on what matters most: creating a great experience for your users.

Here’s a quick rundown of who’s involved:

- The Program Manager: This is the platform (like Swype) bringing the technology and APIs to the table. They’re the architect, designing and running the card program, setting all the rules, features, and how everything looks and feels.

- The Sponsor Bank: This is the regulated bank that actually holds the funds and legally issues the card. They’re the ones making sure everything is above board and compliant with banking regulations.

- The Payment Network: You know these names—Visa, Mastercard. They’re the highways that connect merchants and banks, making sure the card can actually be used pretty much anywhere in the world.

This three-part structure is the engine behind the explosive growth we're seeing. The U.S. prepaid card market hit an incredible $1.76 trillion and is on track to balloon to $10.62 trillion by 2034. That’s not just random growth; it's fueled by businesses of all stripes using these flexible tools for everything from paying their staff to running customer loyalty programs. You can dig into more of the numbers on the growth of the prepaid card market on Precedence Research.

At its core, a card issuing API gives your business the ability to program money. You can dictate precisely how, when, and where funds can be used, transforming a simple payment into a controlled, strategic action.

From API Call to Instant Payout

What does this all look like in the real world? Let’s say you need to pay a freelance designer the moment they finish a project. Forget about slow, clunky bank transfers that take days to clear. Instead, your system makes a single, simple API call.

That one command kicks off a whole chain of events: a new virtual card is instantly created, the exact payment amount is loaded onto it, and the card details are securely sent to the designer. Just like that, they can use it for online purchases or add it to their Apple Pay or Google Pay. It’s a completely seamless, API-driven process that gives you real-time data, total control, and incredible speed for every single payment.

Creating Branded Rewards and Incentive Programs

Let's be honest: generic gift cards from big-box stores are pretty forgettable. A custom-branded prepaid card, on the other hand, makes a real impression every single time it’s pulled out of a wallet. You're not just giving a reward; you're creating a memorable brand experience. Suddenly, a simple payout becomes an ongoing marketing touchpoint.

The whole point is to move beyond one-off gifts and start building dynamic reward programs that foster genuine loyalty and nudge customers or employees toward specific, valuable actions. This is where a developer-first platform completely changes the game. Instead of being stuck with off-the-shelf options, you can use APIs to build a white-label program from the ground up.

That means your logo, your colors, and a card that feels like a natural part of your app or website. It's a seamless experience that reinforces who you are with every single transaction.

Customization Powered by APIs

A modern card-issuing API is the engine running these tailored programs, and it lets you do so much more than just slap a logo on a piece of plastic. Imagine a software company that wants to reward customers for referrals. With an API, they can instantly issue a branded virtual card the moment a successful referral comes through. The API call creates the card, loads the exact reward amount, and zips it over to the customer's inbox in seconds.

Or think about a retail brand looking to build a stickier loyalty program. They could use reloadable prepaid cards where customer points are automatically converted into spendable cash on their branded card. It's a brilliant way to encourage repeat business and make customers feel truly connected to the brand.

The real power lies in the control an API provides. You can programmatically set rules that turn a simple reward into a strategic tool for customer acquisition and retention, all while gathering valuable engagement data in real-time.

Beyond Branding: Dynamic Spending Controls

The flexibility of API-driven prepaid debit cards for businesses goes even deeper, extending to how the funds can be used. This allows you to create highly targeted incentive campaigns that are perfectly aligned with your business goals.

- Merchant Locking: You can lock cards so they only work at specific stores or within certain merchant categories. A corporate wellness program, for example, could issue incentive cards that are only valid at gyms, fitness studios, and health food stores.

- Real-Time Engagement Tracking: Want to know if your program is actually working? An API lets you monitor card activation rates, see where the money is being spent, and calculate the overall ROI. This data gives you immediate feedback on which rewards are hitting the mark.

This move toward digital, controllable rewards isn't just a trend; it's a massive shift. Back in 2020, the prepaid card industry in the UK was already valued at $42.16 billion. During the pandemic, digital gift cards saw nearly 50% year-over-year growth as businesses scrambled for better digital incentive options.

You can dig into more stats about the rise of digital rewards on Coinlaw. By leaning into an API-first platform, your business can build programs that aren't just branded, but also intelligent, measurable, and incredibly effective.

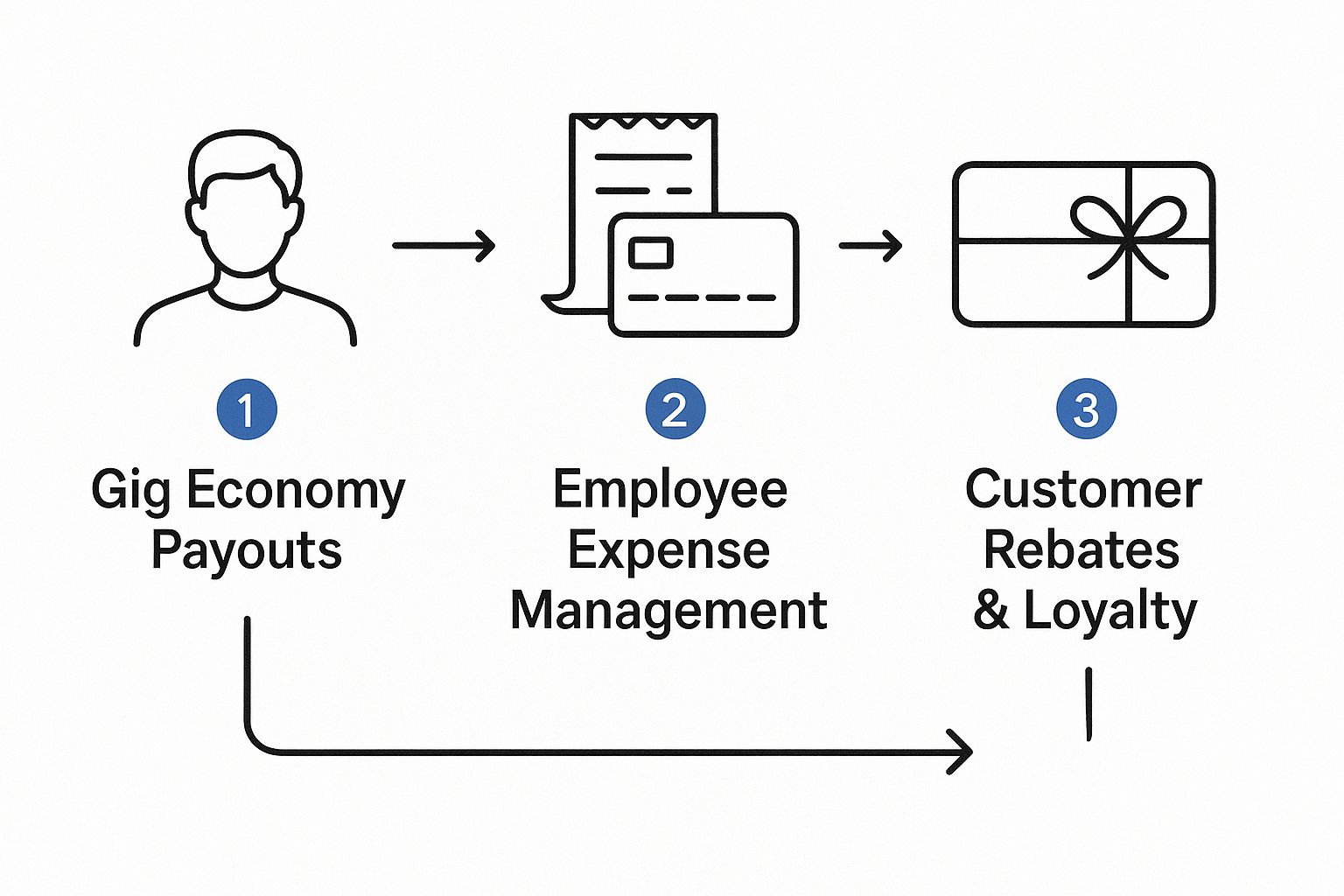

Key Use Cases for Prepaid Card Issuing

The real magic of business prepaid cards isn't in the tech itself, but in what you can do with it. An API-first card issuing platform is a toolkit for solving some of the most common, nagging financial headaches that businesses face every day, especially around payouts and incentives.

We're talking about everything from paying your gig workers the second they finish a job to delighting customers with instant rebates. These API-driven cards make financial operations faster, cleaner, and way more secure.

This infographic lays out a few of the most powerful workflows where businesses are putting prepaid card programs to work.

As you can see, a single card issuing platform can become the command center for completely different financial tasks—from paying contractors to rewarding loyal customers.

Gig Economy and Contractor Payouts

Let's be honest, the gig economy runs on instant gratification. Freelancers, delivery drivers, and independent contractors don't want to wait weeks for a check or a slow bank transfer. That kind of delay is a dealbreaker and can send your best talent running to a competitor.

This is where an API-driven platform like Swype changes the game. Imagine a marketplace for freelance designers. The moment a project gets the green light, an API call instantly creates and loads a virtual card with the exact payment amount. The designer gets their money right now. That instant access isn't just a perk; it's a massive competitive edge for any platform built on freelance talent.

Employee Expense Management

Ah, the classic nightmare of expense reports. The old way—endless paperwork, slow reimbursements, and employees floating company costs on their personal credit cards—is a drain on everyone's time and morale. Prepaid cards offer a much cleaner path forward.

Picture a sales team heading to a conference. Instead of fumbling with personal cards and hoarding receipts, each person gets a company-branded prepaid card loaded with a specific budget. Through an API, you can even lock down spending to certain categories like hotels, meals, or flights.

- Real-Time Control: Need to adjust a spending limit on the fly? You can do it instantly. Approve or deny transactions as they happen.

- Simplified Reconciliation: Every purchase is automatically logged. The soul-crushing task of manual expense reporting simply disappears.

- No More Reimbursements: Your team is never out-of-pocket for business expenses, which is a huge morale booster and cuts down on administrative busywork.

Customer Rebates and Loyalty Programs

Building a loyal customer base is all about creating positive, friction-free experiences. Let's say a manufacturer is offering a $50 rebate on a new gadget. Instead of mailing a paper check that feels like it takes a lifetime to arrive, they can issue a branded virtual card the second the customer registers.

That customer gets their reward immediately and can spend it anywhere. The positive feeling is instantly connected to your brand.

It works the same way for loyalty programs. A coffee shop could use reloadable prepaid cards to turn loyalty points into actual, spendable cash. As customers earn points, their branded card gets topped up automatically. The rewards feel real and valuable, keeping people coming back for more.

When you weave prepaid cards into your daily operations, you start turning routine financial chores into genuine growth opportunities. Whether you’re trying to keep top talent happy, get a grip on spending, or build an army of loyal customers, these cards deliver the speed and flexibility you need to make it happen.

How to Build Your Own White-Label Card Program via API

Launching your own card program probably sounds like a massive headache, but it’s more achievable than you think. In the past, this meant navigating a maze of banking relationships and regulatory red tape. Today, API-first platforms like Swype do all the heavy lifting for you.

This lets you skip the financial plumbing and get straight to what matters: building a killer user experience. Building your own program isn't just about payments; it's a strategic move that turns a simple transaction into a powerful branding tool for your rewards or payout programs.

Let's walk through the five key stages of getting your own solution off the ground.

Step 1: Figure Out Your "Why"

Before you touch a single line of code, you need to be crystal clear on why you're building this program in the first place. This one decision will shape everything that follows, from the card design right down to the specific API calls you'll make.

Are you trying to pay gig workers the second they finish a job? Or maybe you want to create a customer rewards system that people actually remember? Perhaps it's just about taming the wild west of employee expenses.

Each goal demands a different playbook:

- For Payouts: Speed and reliability are everything. Your developers will focus on API calls that create users and load funds instantly.

- For Rewards: It’s all about the experience. You’ll spend more time on custom branding and making the card activation feel special.

- For Expenses: Control is the name of the game. Your integration will lean heavily on features like spending limits and merchant category restrictions.

Step 2: Design the Card and the Experience

With your goal locked in, it’s time for the fun part—designing how your program looks and feels. This is where your brand gets to shine. You'll decide on the card's appearance—logo, colors, and overall vibe—making sure it feels like a natural piece of your company.

But don't just stop at the plastic (or the pixels). Think through the entire user journey. What's the activation process like? What does the digital wallet experience look like? How will people check their balance? A good developer-first platform gives you the API endpoints to build a completely custom, intuitive interface that you control from start to finish.

Step 3: Plug into the Card Issuing API

Here's where the magic really happens. A solid card-issuing API is the technical toolkit that brings your vision to life. With clear documentation and a sandbox environment, your developers can jump in and start building right away.

You'll primarily be working with a few core API functions:

- Creating Users: Onboarding new cardholders into your system programmatically.

- Issuing Cards: Generating virtual or physical cards for each user in an instant.

- Loading Funds: Pushing money onto cards in real-time for payouts or rewards.

- Setting Controls: Applying spending limits, merchant locks, and other rules to dictate how the funds can be used.

Step 4: Nail Down Compliance and Security

Compliance can feel intimidating, but the right platform partner makes it surprisingly straightforward. A modern API-first provider will handle the gnarly requirements like KYC (Know Your Customer) and manage the relationship with sponsor banks to keep everything above board. This means you can build your program without needing a law degree in financial compliance.

The world of prepaid business cards is changing fast, thanks to new tech and tighter regulations. This competition is driving huge improvements in user experience and security. For example, better EMV chip technology cut prepaid card fraud losses by 12% in 2023. Now, businesses get cards with real-time expense tracking and automated reconciliation built right in. You can discover more insights about prepaid card industry trends on Softjourn.

Step 5: Launch and Grow Your Program

Once your integration is tight and compliance is sorted, you're ready to go live. Our advice? Start small. Roll it out to a pilot group to get real-world feedback and iron out any kinks.

When you're feeling confident, you can open the floodgates to your entire user base. A truly scalable API platform will grow right alongside you, handling more and more transactions without breaking a sweat.

Choosing the Right Developer-First Card Issuing Platform

Picking the right technology partner to get your prepaid debit card program off the ground is a massive decision. Not all platforms are created equal, especially when your goal is to create a seamless, white-label experience for payouts or rewards.

For developers and businesses looking to scale, the right choice is about much more than just a piece of plastic. It’s about finding a solid, API-first foundation you can actually build on.

A developer-first platform like Swype doesn’t just sell you a product; they act as an infrastructure partner. The whole point is to give you powerful, flexible APIs to build your ideal white-label card program, instead of boxing you into a pre-built, one-size-fits-all solution.

Core Criteria for Evaluation

When you’re vetting potential platforms, you have to look past the flashy marketing and get down to the technical and operational nitty-gritty. Your development team’s sanity and your program's long-term success depend on it.

Here’s what you should really be looking at:

- API Quality and Documentation: Is the API documentation actually clear, complete, and easy for your developers to work with? A good platform provides a clean sandbox environment so your team can test and build without any real-world risk.

- Customization and White-Labeling: How deep can you go with customization? You need control over everything from the card’s look and feel to the user activation process, making sure your brand is always front and center.

- Scalability and Reliability: Can the platform handle a serious volume of transactions without breaking a sweat? As your business grows, your card issuing partner has to be able to grow right there with you, no questions asked.

The most crucial element here is the partnership model. A true developer-first platform gives you the tools and support to build your own financial products. That distinction is everything for businesses that want to do something truly innovative with their payout and incentive programs.

Financial and Security Considerations

Finally, let's talk about the non-negotiables: pricing and security. Hidden fees can absolutely torpedo the ROI of your program before it even gets going. You need to find a partner with a transparent pricing model where the costs are spelled out clearly from day one.

Just as critical is the platform's commitment to compliance and security. Make sure they have a rock-solid infrastructure that handles all the KYC/AML requirements and sticks to strict security standards like PCI-DSS. This is what lets you launch your program with confidence, knowing all the complex regulatory stuff is being handled by experts.

Got Questions? We've Got Answers.

How Quickly Can We Launch a Custom Payout or Rewards Program?

You're probably used to thinking in terms of months, right? Long negotiations with banks, piles of paperwork... that's the old way. With a modern, API-first platform, you can shrink that timeline from months down to just days or weeks.

The whole point is speed. Integrating with a robust API means you can get your business's custom prepaid debit card program for payouts or rewards off the ground before the competition even knows what's happening.

What’s the Deal with Compliance and All the Red Tape?

Let's be honest, navigating the world of KYC (Know Your Customer) and AML (Anti-Money Laundering) is a full-time job in itself. It’s complex and the stakes are high. The good news? You don't have to become a compliance expert overnight.

The right card-issuing partner handles all of that heavy lifting for you. They already have the relationship with the sponsor bank and ensure the entire program is buttoned up and compliant with financial regulations. This frees you up to focus on what you do best: building a great product and experience for your users.

Can We Actually Control How These Cards Are Used?

Absolutely—and this is where things get really powerful. One of the biggest perks of an API-driven platform is the ability to set incredibly specific, granular rules.

Think of it like this: you can programmatically set spending limits, fence off purchases to certain merchant categories (like office supplies or travel expenses), and even block specific transactions as they happen. It's the ultimate tool for making sure company funds are always used exactly as you intended.

Physical Cards vs. Virtual Cards: Which is Best for Payouts and Rewards?

It really comes down to how people will be using the money.

- Virtual cards are digital-only. They're issued instantly and are perfect for online shopping or adding to a mobile wallet like Apple Pay. This makes them ideal for immediate customer rewards or quick payouts.

- Physical cards are the classic plastic you can hold in your hand. They're what you need for in-store purchases at a checkout terminal.

The best choice isn't about which is "better," but which one makes the most sense for your specific program and what you want your recipients to be able to do.

Ready to stop wondering and start building? Swype provides the developer-first API platform you need to issue, manage, and scale your prepaid card solutions for payouts, rewards, and incentives. Build with Swype today.