Think of a payments gateway API as the digital middleman that connects your online store to the vast, complex world of banking. It’s the invisible engine that makes online sales happen, securely juggling payment data in the blink of an eye. Honestly, without it, e-commerce as we know it would grind to a halt.

Understanding How a Payments Gateway API Works

So, what’s really going on when a customer clicks "Pay"? The payments gateway API is the choreographer of that entire transaction. It’s a highly secure translator that allows your website, your customer's bank, and your bank to all speak the same language—instantly and safely.

The whole dance, from the customer entering their card details to getting that "payment successful" message, usually takes just a couple of seconds. This lightning-fast communication is what creates the smooth, seamless checkout experience everyone now expects.

The Journey of a Single Transaction

To really get it, let's trace the path of a customer's payment information. It’s a whirlwind tour involving several key players, and it all happens faster than you can blink.

- Data Capture and Encryption: The moment a customer types their credit card details on your checkout page, the gateway’s API swoops in and encrypts everything. The card number, expiration date, and CVV are scrambled into unreadable code, making them completely useless to any digital eavesdroppers.

- Secure Transmission: This encrypted bundle of data is then shot over from the customer's browser directly to the payment gateway's secure server. This is a crucial step because it means that sensitive information never even touches your own servers, which massively reduces your PCI compliance headache.

- Routing to the Processor: Once the gateway has the data, it zips the transaction details over to the right payment processor. This is the company with direct lines to the major card networks like Visa, Mastercard, and American Express.

- Authorization Request: The processor then forwards the request to the correct card network, which in turn passes it along to the customer’s issuing bank (the one that gave them the card). The bank quickly checks for available funds and runs its own fraud detection algorithms.

- Approval or Decline: The bank sends a simple "approved" or "declined" message back up the chain—from the card network to the processor, and then back to the payment gateway.

- Communicating the Result: Finally, the gateway’s API delivers this final verdict back to your website. This is when your customer sees either a confirmation or an error message. Behind the scenes, the gateway is already starting the process of moving the approved funds into your merchant account.

A payment gateway API doesn't just process a payment; it manages a high-stakes conversation between multiple financial institutions, ensuring every message is secure, authenticated, and delivered in near real-time.

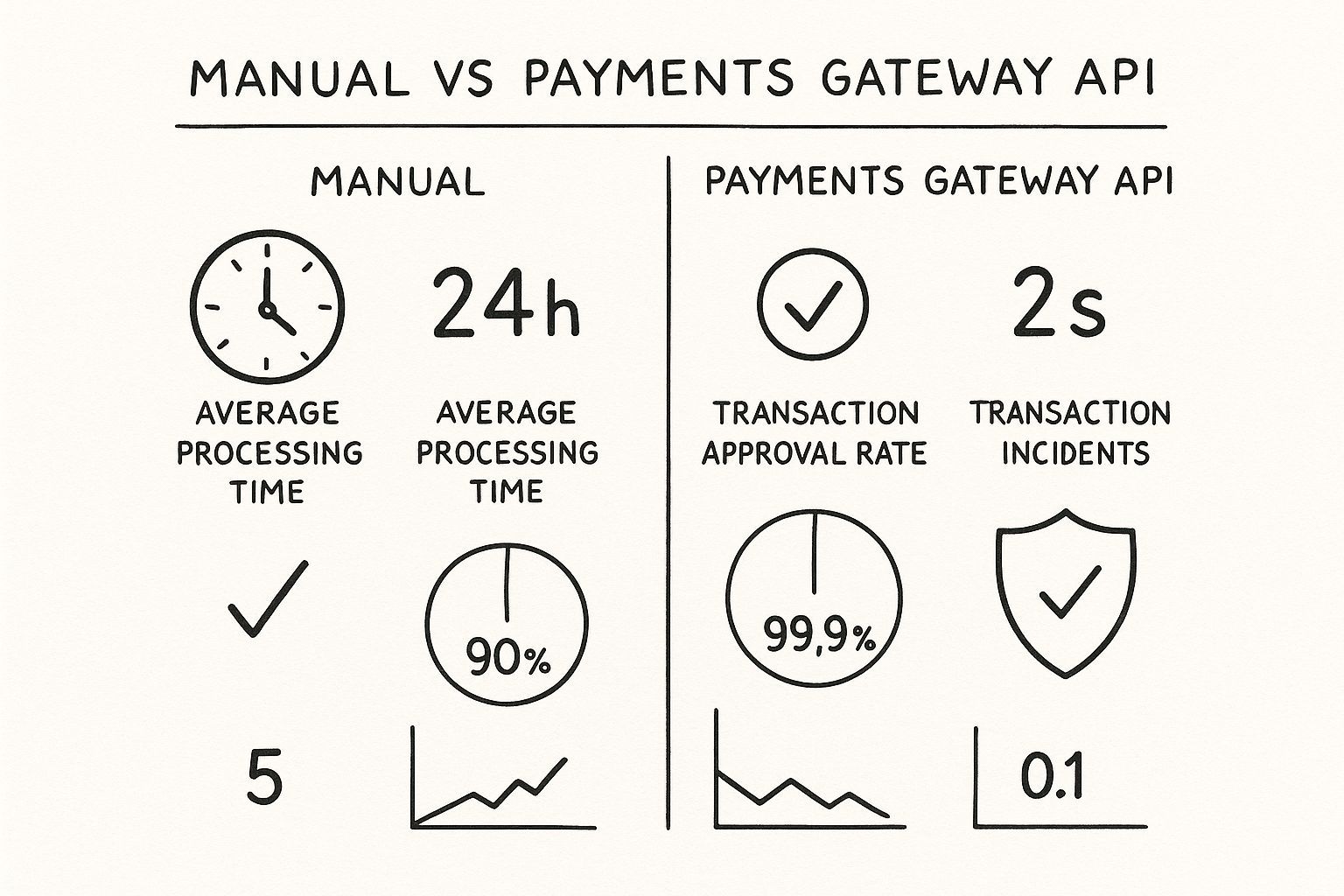

This kind of automation is the bedrock of modern e-commerce. This infographic lays out the stark difference in efficiency between an API-driven process and trying to handle payments manually.

The numbers make it clear: automated systems aren't just faster—they're significantly more reliable and secure, which has a direct impact on your revenue and your customers' trust.

This reliance on API-driven payments is why the market is absolutely exploding. The global payment gateway market was valued at USD 42.68 billion and is on track to hit USD 146.28 billion by 2030, all thanks to the unstoppable growth of e-commerce. If you want to dive deeper, you can check out the complete payment gateway market analysis.

Choosing Your Gateway API Integration Model

Not all payment integrations are built the same. Once you’ve decided to bring in a payment gateway API, you’ll face a critical choice—one that will define your customer’s checkout experience, your team’s development workload, and where your security responsibilities lie. The two main paths are using a hosted gateway or building a direct API integration.

Think of it like setting up a new retail shop. A hosted gateway is like renting a secure, pre-built kiosk in a busy mall. It’s simple, it’s safe, and the mall operator (the gateway provider) handles most of the heavy lifting for security and compliance. On the other hand, a direct API integration is like designing and building your own custom boutique from the ground up. You get total control over the brand experience, but you're also responsible for everything inside.

This decision touches everything, from the checkout flow your customers see to your long-term maintenance costs. Let's break down what each model really means for your business.

The Hosted Gateway Model

The hosted payment gateway, often called a "redirect" model, is the most straightforward route. When a customer is ready to pay, your site simply sends them over to a secure payment page that’s hosted and managed entirely by the gateway provider.

After they enter their details and the payment goes through, they’re sent right back to your site with a confirmation. This hands-off approach is popular for a good reason: it dramatically simplifies your security burden. Because you never handle or store raw card data on your own servers, the headache of achieving strict PCI DSS compliance is significantly reduced.

This simplicity is a huge driver of market trends. Hosted payment gateways currently command 62% of the global market revenue, mostly because they streamline compliance and get merchants of all sizes up and running fast. This model is a go-to choice for both small businesses and large enterprises, which together make up 55% of the user base. You can explore more payment gateway statistics to see a full market breakdown.

The Direct API Integration Model

A direct API integration, also known as a non-hosted model, gives you maximum control. With this approach, the entire checkout process happens on your website or inside your app. You build your own payment form, and the payment gateway API works silently in the background to capture, tokenize, and process the transaction data.

This creates a completely seamless, branded experience for your customers without any jarring redirects to an external site—a common friction point that can lead to abandoned carts. But all that control comes with more responsibility. While modern tools like client-side encryption and tokenization help immensely, your systems are more involved in securing the transaction, which naturally broadens your PCI compliance scope.

A direct API integration embeds the payment process into your brand's journey, making it invisible to the customer. A hosted gateway makes the payment process a distinct, separate step managed by a trusted third party.

Making the Right Choice for Your Business

So, which path is right for you? There’s no single correct answer. The best choice really boils down to your specific business needs, technical resources, and what you’re trying to achieve long-term.

To help guide your decision, here’s a straightforward comparison of how the two models stack up.

Hosted vs Direct API Integration Comparison

This table directly compares the key characteristics of hosted and direct payment gateway API integrations to help businesses make an informed choice.

| Feature | Hosted Gateway (Redirect) | Direct API Integration (Non-Hosted) |

|---|---|---|

| Customer Experience | Customer is redirected to a separate page to pay, which can feel disjointed. | Seamless checkout entirely on your site, offering full brand control. |

| Security & PCI | Greatly simplified compliance, as the gateway handles sensitive data. | Larger PCI scope, as your systems are more involved in data capture. |

| Implementation | Faster and easier to set up with minimal development resources required. | More complex and time-consuming, requiring skilled developer involvement. |

| Customization | Limited control over the look and feel of the payment page. | Complete freedom to design and optimize the checkout flow. |

| Best For | Businesses prioritizing speed to market, simplicity, and minimal security overhead. | Businesses focused on brand consistency and a highly customized user journey. |

Ultimately, choosing your integration model is a strategic decision. You're balancing the convenience and security of a hosted solution against the control and customization offered by a direct payment gateway API integration.

Exploring the Core API Components

To really get what a payments gateway API does, you have to look under the hood at its essential building blocks. These parts all work together in a finely tuned sequence, making sure every single transaction is secure, authenticated, and logged correctly. Think of it like a high-tech kitchen where each station has a specific, critical job to do.

If you skip over understanding these core pieces, you might cobble together a system that works, but you won’t know how to fix it when it inevitably breaks or how to truly lock it down for security. Let's pull back the curtain on the key components that make a modern payment system tick.

Authentication: Your Digital Handshake

Before a single cent can move, your application needs to prove it is who it says it is. This is where authentication comes in, acting as the secure digital handshake that grants you access to the gateway. The whole thing is handled with API keys.

An API key is just a unique, secret string of characters that your system sends along with every request. It’s like a top-secret password that tells the gateway, "Yep, this request is legit and comes from an authorized merchant."

You’ll usually get two types of keys:

- Public Key: This one is used on your front-end—like your website's checkout page—to identify your account without giving away the keys to the kingdom.

- Secret Key: This is for your back-end server only. It's used for sensitive actions like actually creating charges or issuing refunds. You have to guard this one fiercely.

Protecting your secret key is everything. If it gets compromised, a bad actor could potentially process fraudulent transactions on your account. Its security is job number one for your dev team.

Tokenization: The Secure Valet Key

Once you’re authenticated, the next big job is to handle the customer's payment details without creating a massive security risk. This is where tokenization shines, adding a powerful layer of security. Instead of letting raw credit card numbers even touch your server, the API swaps them for a secure, meaningless placeholder called a "token."

It’s like leaving your car with a valet. You don't hand them your master key that also opens your house and your office; you give them a special valet key that can only start the car. A payment token works the same way. It can be used to process that specific transaction, but it's completely useless to a thief if it’s intercepted.

This process massively reduces your PCI compliance burden. Since the actual card number never hits your systems, you offload the high-risk data storage onto the payment gateway, which has the fortress-like infrastructure to protect it.

By using tokenization, you're not just securing a single transaction; you're fundamentally lowering your company's risk and liability. It’s an absolute must for modern payment security.

Payment Endpoints: The Action Commands

With your identity verified and customer data secured, you need a way to actually tell the gateway what to do. That's the job of payment endpoints. An endpoint is just a specific URL within the API that corresponds to a particular action.

Think of endpoints like different departments in a company. Need to process a new sale? You send a request to the /charges endpoint. Need to give a customer their money back? You’ll be talking to the /refunds endpoint. Each one is built for a specific task.

Some of the most common endpoints you'll find include:

- Charges: For creating a new payment.

- Authorizations: To reserve funds on a card without immediately capturing them.

- Refunds: For returning money to a customer.

- Customers: To create and manage customer profiles and their saved payment methods.

- Subscriptions: For handling all the logic around recurring billing.

Your app sends a structured request to the right endpoint, and the API fires back a response letting you know if it worked.

Webhooks: Your Real-Time Notification System

Finally, not everything in payments happens instantly. A bank transfer might take a few days to clear, or a subscription renewal might process in the middle of the night. You can’t just have your server sitting around waiting. This is where webhooks are a lifesaver.

A webhook is simply an automated message the payment gateway sends to your system when a specific event happens. Instead of your server constantly pinging the gateway and asking, "Is it done yet?", the gateway proactively tells you the moment a payment succeeds, fails, or a dispute is filed.

This real-time communication lets you automate all sorts of crucial business logic. For example, when a payment.succeeded webhook arrives, you can automatically trigger an order shipment, grant access to a digital product, or fire off a confirmation email. It’s the final piece that makes your payment system truly dynamic and responsive.

How to Select the Right Payments Gateway API

Choosing a payments gateway API is more like picking a long-term business partner than just buying a piece of software. Get it right, and it’s a growth engine. Get it wrong, and you’re stuck with customer friction and operational headaches.

This decision deserves a lot more than a quick glance at a pricing page. You have to move past the flashy marketing and dig into the core features that actually matter. Let's cut through the noise and break down how to pick a gateway that works for you today and scales with you tomorrow.

Analyze the Pricing Models

Cost is usually the first thing people look at, but the cheapest option is rarely the best. Payment gateway pricing can get complicated fast, so you need to understand the two main models to figure out what you'll really be paying.

- Flat-Rate Pricing: This is the simple one. The gateway charges a single percentage plus a small fixed fee for every transaction (think 2.9% + $0.30). It’s predictable and easy to forecast, which makes it a great fit for startups or any business with a lot of smaller transactions.

- Interchange-Plus Pricing: This model is a bit more complex but can be a game-changer for high-volume businesses. It separates the non-negotiable "interchange" fee (what the customer's bank takes) from the gateway's markup (the "plus"). It’s transparent, so you see exactly what you’re paying for.

A coffee shop selling $5 lattes has totally different needs than a B2B software company closing $5,000 contracts. Your business model dictates which pricing structure makes sense.

Prioritize Robust Security Features

In payments, security is everything. A data breach doesn't just cost you money in fines; it can completely destroy your customers' trust. Your gateway API needs to be a fortress.

Look for these non-negotiable security pillars:

- PCI DSS Compliance: Your provider must be Level 1 PCI compliant—that's the highest standard. This means they handle sensitive card data in a secure environment, which massively reduces your own compliance burden.

- Tokenization: As we’ve covered, this is a must-have. The API should swap sensitive card numbers for secure tokens so you never have to store the raw, risky data on your own systems.

- 3D Secure 2 (3DS2): This is the modern standard for authenticating online card payments. It adds an extra security check that helps shut down fraudulent chargebacks, which is especially critical if you do business in Europe where it's often required.

Selecting a gateway is an exercise in risk management. The provider you choose becomes your frontline defense against the ever-present threat of payment fraud.

Evaluate Supported Payment Methods

Today's customers expect to pay their way. If you only offer credit cards at checkout, you're leaving money on the table. Digital wallets and other alternative payment methods are no longer "nice to have"—they're essential.

Think about a global e-commerce store. To actually succeed, it has to accept more than just Visa and Mastercard. It needs regional favorites like iDEAL in the Netherlands or UPI in India. A subscription business, on the other hand, needs rock-solid support for recurring billing and automated card updaters to keep involuntary churn down.

Make sure your gateway can handle:

- Major credit and debit cards

- Digital wallets (Apple Pay, Google Pay)

- Buy Now, Pay Later (BNPL) services

- Bank transfers and direct debits

- Local payment methods specific to your key markets

Assess Global and Currency Capabilities

If you have any plans to sell internationally, global capabilities are a must. And I don't just mean accepting international cards. I'm talking about true multi-currency processing.

This lets you charge customers in their local currency while you get paid in yours. It’s a huge boost to the customer experience—shoppers are way more likely to buy when they see prices they instantly recognize. A gateway that also manages the currency conversion and international settlement for you removes a massive operational headache.

Choosing a partner with a strong international footprint today prepares your business for the growth you’re planning for tomorrow.

Payments Gateway APIs in Action

A payments gateway API is way more than a chunk of code; it's a strategic tool that fuels modern business. You really see its power when you look at how different companies use it to tackle specific problems and make buying things a breeze for their customers. From a simple online shop to a sprawling global marketplace, a good API is flexible enough to fit just about any business model.

Let's jump from the theoretical to the practical and see where this technology is making a real difference. You’ll see how specific API functions unlock all sorts of sophisticated payment setups that bring in revenue and keep customers coming back.

E-commerce One-Time Purchases

For your typical e-commerce store, the mission is simple: make buying a product as quick and painless as possible. The payments gateway API is the engine running the whole show, handling that classic "add to cart, click to buy" journey everyone knows.

When a customer hits the checkout, the API securely manages the entire transaction from start to finish. It calls endpoints designed for a single charge, getting the payment authorized and captured in just a few seconds. This straightforward, one-off payment is the bread and butter of online retail.

The main job of a payments gateway API in e-commerce is to make the payment step feel invisible. A great integration is so smooth the customer barely registers it, which is a huge deal for cutting down on abandoned carts.

Subscription Services and Recurring Billing

Now, think about a subscription business—like a streaming service or a SaaS platform. They have a totally different challenge. They need to charge customers over and over again on a set schedule without making them pull out their credit card every single time. This is where tokenization is the unsung hero.

During that first sign-up, the API grabs the customer's card info and immediately swaps it for a secure token. This token is what gets stored, not the sensitive card number itself. The business can then use that token to trigger future payments automatically through the API’s subscription functions.

The key API features in play here are:

- Customer Creation Endpoints: To set up a customer profile in the gateway's system.

- Tokenization: To safely link payment methods to that profile.

- Subscription Logic: To handle billing cycles, free trials, and plan upgrades or downgrades.

- Webhooks: To get instant notifications when payments succeed or fail, which lets them automate things like retrying a failed charge or sending a "payment failed" email.

Marketplace Platforms and Split Payments

Marketplaces like Etsy or Airbnb are playing on a whole other level of complexity. When a customer buys something, the platform has to take that one payment and split it between the person selling the item and themselves, carving out a commission.

This kind of magic requires a more advanced payments gateway API, often with features called adaptive payments or connected accounts. The API handles the entire flow:

- The customer is charged a single amount.

- The API then programmatically divides the funds based on rules you’ve set up.

- The seller gets their cut, and the platform gets its fee, all in one go.

This is what allows marketplaces to grow without getting buried in the manual work of processing thousands of individual payouts. It creates a solid, automated financial system that works for everyone involved.

The worldwide shift to these API-driven payment models is completely changing how we buy and sell. The Asia-Pacific region, for example, now makes up about 38% of the entire global payment gateway market, thanks to a massive explosion in mobile payments. Meanwhile, in North America, where over $1.08 trillion in digital payments were processed, people are demanding flexible choices like Buy Now, Pay Later—all of which are powered by APIs. You can dive deeper into these global payment gateway trends to see just how big this has become.

Common Questions About Gateway APIs

Jumping into the world of payment gateway APIs can bring up a lot of questions, especially when you start thinking about the nitty-gritty of implementation. It’s one thing to understand the concepts, but another to figure out security, costs, and whether you’re locking yourself into one provider forever.

Let's tackle some of the most common questions head-on. Getting these answers straight will help you move forward with confidence and make smarter choices for your business.

What Is the Difference Between a Payment Gateway and a Payment Processor?

Think of it like this: the payment gateway is the secure messenger, and the payment processor is the central bank. They have distinct, but tightly connected, roles in making a transaction happen.

The payment gateway is the piece of technology that lives on your website or app. Its API is responsible for securely grabbing a customer's payment details, encrypting them, and then safely passing that information along. It's your front-door security guard.

The payment processor, on the other hand, is the heavy lifter working behind the scenes. It takes that secure message from the gateway and handles all the complex financial plumbing—routing the transaction through card networks like Visa, talking to the customer’s bank to get the thumbs-up, and managing the actual money movement. While some companies bundle both services, they’re still two separate functions.

How Does a Gateway API Keep Payments Secure?

A solid payments gateway API is your first line of defense against fraud and costly data breaches. It’s built on a multi-layered security strategy, but two methods are absolutely critical for keeping sensitive data locked down.

First is encryption. The API uses Transport Layer Security (TLS) to scramble payment data the moment it leaves the customer's browser. This makes the information totally unreadable to anyone who might try to intercept it on its way to the gateway's servers.

Even more important, though, is tokenization.

Tokenization is the process of swapping a customer's real credit card number for a unique, meaningless string of characters called a "token."

Your system stores this safe token, not the actual card number. This is a game-changer. It dramatically shrinks your PCI compliance burden and liability because you never have to touch or store the raw, high-risk card data yourself. You can charge that customer again later using just the token, effectively outsourcing the hardest parts of payment security to a partner built to handle it.

Is It Difficult to Switch Payment Gateways Later?

The answer can range from "a minor inconvenience" to "a complete logistical nightmare." It all boils down to one crucial factor: data portability. Can you take your customers' saved payment information with you if you leave?

If your customers' payment methods are stored as tokens with your current gateway, you need to know if that provider will help you export those tokens and transfer them securely to a new one. Some gateways are built for this kind of flexibility and make the process straightforward.

Others, however, make it intentionally difficult, creating a "vendor lock-in" that can trap you. You might be stuck with a provider long after their pricing, features, or reliability no longer make sense for your business.

- Always ask direct questions about data portability and token export policies before you sign up. Planning for a potential switch from day one is one of the smartest strategic moves you can make. It will save you a world of hurt down the road.

What Are Webhooks and Why Are They Important?

Webhooks are automated, real-time messages that one system sends to another when something specific happens. For a payments gateway API, they are absolutely essential for building a modern, efficient operation.

Imagine you’re waiting on a bank transfer. Without webhooks, your server would have to constantly ask the gateway's API, "Is it done yet? How about now? Is it done yet?" This is called polling, and it’s incredibly inefficient.

A webhook flips this around. The gateway simply sends your system an instant notification the moment the transfer is complete. This event-driven approach is far smarter.

Webhooks are used to communicate critical status changes for things that aren't instant, like:

- A recurring subscription payment succeeded (or failed).

- A customer has initiated a chargeback.

- A refund has been fully processed.

- A bank transfer has cleared.

By listening for these webhook notifications, you can automate all kinds of follow-up tasks—like shipping an order, updating an account status, or sending a receipt—making your entire business run that much smoother.

Ready to streamline your global payouts with a simple, secure API? Swype provides a powerful platform for sending and managing virtual Visa and Mastercard cards worldwide. Our developer-friendly API makes it easy to issue rewards, incentives, and stipends, delivering a seamless experience for your recipients from activation to spending.

Learn more about Swype's virtual card API and start building today.